Last Wednesday Warren Buffett and private-equity firm 3G Capital announcedthey’re merging H.J. Heinz with Kraft Foods. Business Insider boiled the deal down to that scary word “synergies” – specifically “from the increased scale of the new organization, the sharing of best practices and cost reductions.” News coverage is pouring in. Analysts are parsing the deal sheet. Meanwhile, every Heinz and Kraft employee is worried about how those synergies will impact them personally – yet they’re lost amid the swirl of news and rumor.

How will Buffett and 3G manage the balancing act ahead? They’ll need to avoid organizational paralysis, keep employees and leaders focused on the work to be done to serve customers – all while achieving those synergies and retaining key talent during a time of tremendous change and uncertainty. Once again, the “soft stuff” (people) is actually the hardest part of any M&A.

The stakes couldn’t be higher. This massive deal is valued at $36 billion and required a $10 billion capital injection from Buffett and 3G. But the Heinz-Kraft merger is also happening in a high-stakes context. Mergers are on the rise: experts estimate 5,844 M&A deals this year alone, valued collectively at $1.04 trillion. Despite the potential smart M&A can unlock, most deals disappoint. Between 50 – 70% of deals fail to achieve anticipated results. A KPMG study found over half of M&A deals actually destroy shareholder value.

Why? It’s usually a “people thing.” According to Bain & Company, 60 – 70% of synergy realization in M&As come directly from “soft factors”: strategic alignment of the merging businesses, smooth organizational integration and low employee resistance.

So how can the Heinz-Kraft team tackle the “people factor?” Here are three recommendations to get this merger on the path to success:

- Plan for the complexity of the challenge.

Research suggests that thoughtful M&A communications that address the human and emotional aspects of change yield much better outcomes. Consider the following:

- A PwC survey found early communication strategy drives favorable outcomes in profitability(59%), gross margin and cash flow (64% each).

- It’s worth noting that M&A deals with longer planning cycles (12-18 months from announcement to integration) are 150% more likely to succeed than faster-moving deals.

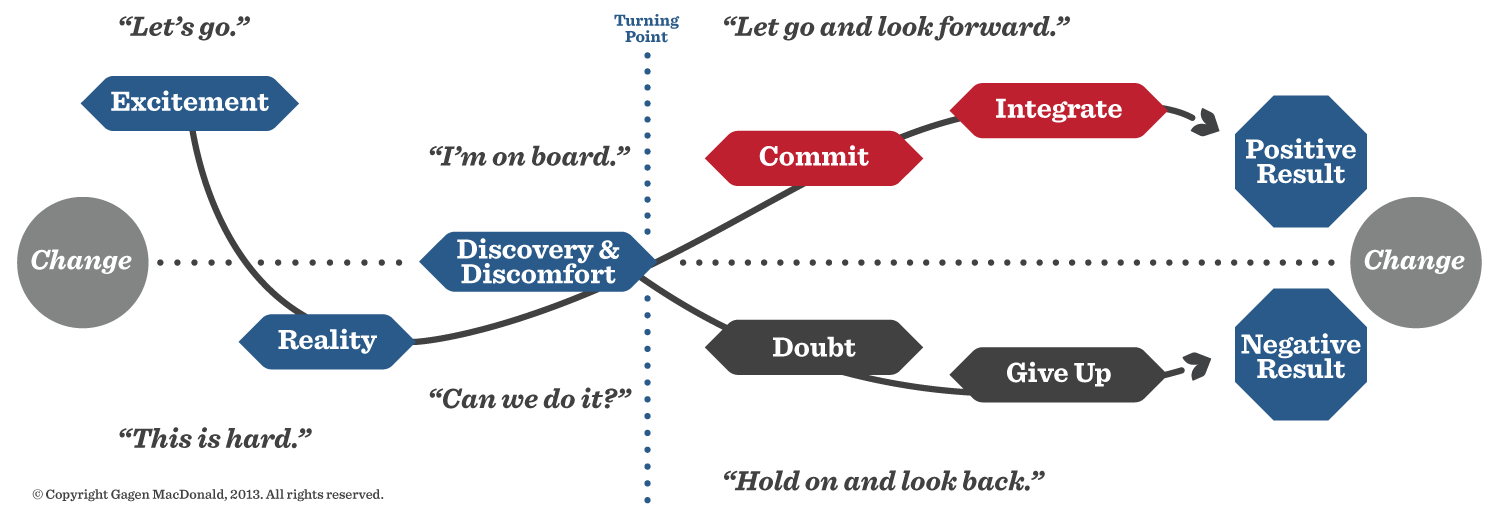

Managing the momentum of change is key. Any M&A communications plan must acknowledge that transformative change is emotionally difficult and will involve setbacks. When you consider the cycle of change (see diagram below), typically any change momentum begins with a high degree of leadership focus and excitement. Then, the real work sets in, and leaders must create momentum and regular leadership communication “interventions” to engage the organization regularly and help move people quickly through the cycle of change. (More guidance on this in #3.)

Celebrate incremental wins. Encourage the troops when temporary setbacks occur. Highlight visible actions towards the "big picture" the company is driving towards.

- Communicate with employees fast.

The Heinz-Kraft dealmakers are plainly excited by the deal’s prospects. The combined company will be the fifth largest food and beverage company worldwide, rivaling Nestle. It will consolidate an impressive portfolio of brands dominating American pantries. Cost savings from the deal will fund acquisitions of “companies more closely aligned with emerging consumer trends”, according to one analyst in USA Today.

While management wants to talk about the new company’s global leadership and forward-looking product categories, rank-and-file employees want to hear answers to very different questions. Who is going to run the business? What will change? Do I have a future here? What should we tell customers, suppliers and other partners? M&A communications should address these threshold questions at the earliest opportunity and give clear, consistent answers as more details emerge. And it’s ok to say, “I don’t know.” Being open and honest with employees that you are working through the details and will inform them as soon as possible is a much better approach than silence.

Integration is difficult work that requires keeping everyone – but particularly your superstars - engaged. A Mercer report reveals that 81% of employees stay engaged if employees feel change is well-managed. If not, engagement drops to 42%.

- Create the compelling story for change.

Heinz and Kraft are storied American brands, and employees are rightfully proud of that heritage. The Heinz-Kraft dealmakers must remember that getting people excited about a new collective future also means asking them to give up some of their past. To bridge that change, it’s crucial to create a new story with a compelling rationale that goes beyond the dollars and cents and touches employees’ emotions and then equip leaders to be able to tell it authentically and confidently. The best stories come from tapping into both companies’ brands, cultures, and histories to create a powerful vision for the new enterprise.

By putting these three recommendations into action, Heinz and Kraft employees will then connect heads, hearts and hands and embrace the combined company’s future to unlock this exciting deal’s full value.